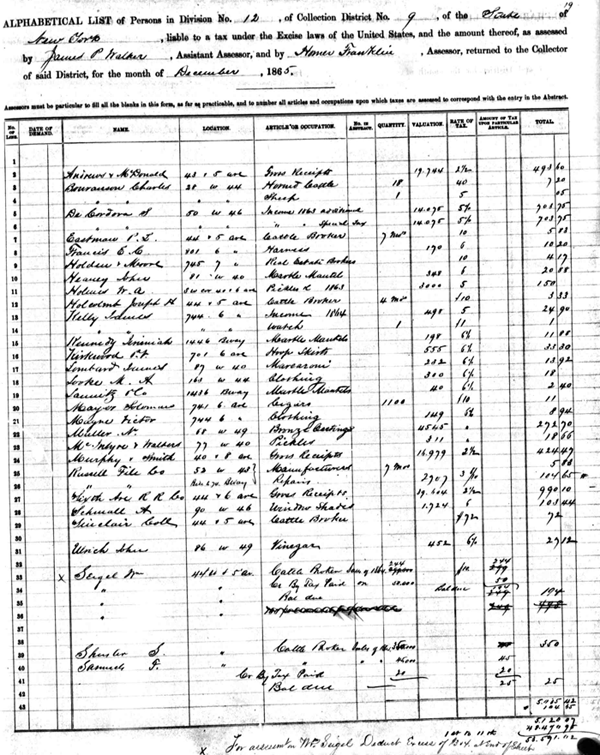

On the day before the 15 April tax deadline, there aren’t a whole lot of people with the “warm and fuzzies†for the IRS, but this year family historians may soften their opinion of that particular government institution thanks to a new database at Ancestry.com. In last week’s newsletter you may have seen links to a new database–U.S. IRS Tax Assessment Lists, 1862-1918. (Click on the image to enlarge a sample from this collection.) This week I had a chance to dig deeper into this database and I’m ready to share what I’ve learned.

On the day before the 15 April tax deadline, there aren’t a whole lot of people with the “warm and fuzzies†for the IRS, but this year family historians may soften their opinion of that particular government institution thanks to a new database at Ancestry.com. In last week’s newsletter you may have seen links to a new database–U.S. IRS Tax Assessment Lists, 1862-1918. (Click on the image to enlarge a sample from this collection.) This week I had a chance to dig deeper into this database and I’m ready to share what I’ve learned.

About the Records

Because of the cost of the Civil War, the American government was in need of money. As a result, the first income tax (for individuals) was enacted by Congress in July of 1862. Most of the Confederate states were not initially taxed, but as they came under federal

control, taxes were imposed.

This income tax was challenged after the war, but it was not until 1895 that the Supreme Court ruled that the tax was unconstitutional. (In 1913, the sixteenth amendment would re-impose the income tax.) Upon the 1895 ruling, the individual tax returns of our ancestors were destroyed, but the assessors’ lists were retained because they included references to licenses and other taxes. Those that survived the years were eventually microfilmed by the National Archives. Within these records–in addition to income taxes–you’ll see taxes on watches, pianos, carriages, estates, silver, billiard tables, and

securities, as well as various other items.

Putting the Records in Perspective

The National Archives’ Prologue magazine ran an interesting and very helpful article on this collection in its Winter 1986 issue–Income Tax Records of the Civil War Years, by Cynthia G. Fox. You can find it online through the Archives.gov website.Â

The article provides background information and discusses what items were taxable. It also includes some information that can help to put your ancestor’s wealth in perspective. In it I also found the following information about the average costs of consumer goods in Maryland in 1869.

“. . .the average rent on a six-room house in Maryland was $10 per month. Consumer goods and food were also very reasonable in Maryland. Extra fine flour sold for $8 per barrel, roasted coffee was 35 cents per pound, beef was 15 cents per pound, butter was 40 cents per pound, eggs were 22 cents per dozen, coal was $8.50 per ton, medium quality satinets were 50 cents per yard, and men’s heavy boots could be had for $5.25 a pair. In 1865 gold sold for $145 per ounce.â€

(You can also compare the value of the 1860s dollar to today’s value at MeasuringWorth.com.)

Searching the Database

The database doesn’t have a lot of search options, but you can narrow down your search by state. Records are arranged by assessment districts–each district representing a particular geographic area. You can find out what counties are included in a particular district by first checking the microfilm catalog of the National Archives.

Access the catalog and click the blue “Microfilm†button. On the following page, you can search for films. Enter the NARA microfilm number for the state you’re interested in. For example, for Indiana, you’d enter M765. (I’ve posted the film numbers for each state at the end of this article.)

Since you have entered a specific film number, you’ll likely only get one search result. Click on it. On the next page you’ll see a publication details PDF that includes geographic descriptions of each district. (Note: One exception I noted is New Jersey. It is bundled with New York and only gives the record type–annual, monthly, special, etc.–and the dates it covers by district.)

Now, when I look at the search results at Ancestry.com, I just hover the mouse over each entry and Ancestry will show me a summary of the record that tells what district the entry is located in. I only have to check entries for the districts I’m interested in.

Miscellaneous Tips

Here are a few more tips you may find helpful when searching this database.

- Because the records in the collection vary quite a bit, you may find multiple records for the same individual, as I did with my relative James Kelly. Don’t stop with the first entry you find; there may be more out there.

- Within the district, pages are arranged by geographical divisions. Looking at the addresses I found another person listed with the same address as my ancestor, and several others within a few house numbers. These lists give a unique look at the neighborhood and the types of people living around our ancestors.

- Be sure to read the headers on each page; they will help you better understand the contents. I found James on a list with the heading “Alphabetical List of Persons in Division No. 12 of Collection District No. 9, of the State of New York, liable to a tax under the Excise laws of the United States.†On this page taxable occupations or items were listed.Â

- In the example I posted with the announcement on the blog last week, I found my Kelly clan listed together as they were taxed on the estate of the family patriarch. In this case, they were listed in a district other than the one in which James lived–perhaps the district in which Elizabeth Kelly (co-executor of the estate) lived. Finding the family listed together was very cool, and had I not known when the family patriarch (another James Kelly) had died, this would have helped me narrow it down.

I spent an interesting couple of days searching through these records and I’ll probably revisit them again when I get the chance. I gained some insights into the Kelly family and the neighborhood in which they lived. Although we may dread “when the taxman cometh,†it’s nice to know he also leaveth records.

Click here to search the IRS Tax Assessment Records at Ancestry.com.

Here are the NARA Film numbers, and states and years covered:

- M754, Alabama, 1865-1866, 6 rolls

- M755, Arkansas, 1865-1866, 2 rolls

- M756, California, 1862-1866, 3 rolls

- M757, Colorado, 1862-1866, 3 rolls

- M758, Connecticut, 1862-1866, 23 rolls

- M759, Delaware, 1862-1866, 8 rolls

- M760, District of Columbia, 1862-1866, 8 rolls

- M761, Florida, 1865-1866, 1 roll

- M762, Georgia, 1865-1866, 8 rolls

- M763, Idaho, 1865-1866, 1 roll

- M764, Illinois, 1862-1866, 63 rolls

- M765, Indiana, 1862-1866, 42 rolls

- M766, Iowa, 1862-1866, 16 rolls

- M767, Kansas, 1862-1866, 3 rolls

- M768, Kentucky, 1862-1866, 24 rolls

- M769, Louisiana, 1863-1866, 10 rolls

- M770, Maine, 1862-1866, 15 rolls

- M771, Maryland, 1862-1866, 21 rolls

- M773, Michigan, 1862-1866, 15 rolls

- M775, Mississippi, 1865-1866, 3 rolls

- M776, Missouri, 1862-66, 22 rolls

- M777, Montana, 1864-1872, 1 roll

- M779, Nevada, 1863-1866, 2 rolls

- M780, New Hampshire, 1862-1866, 10 rolls

- M603, New Jersey, 1862-1866, rolls 1-17 (with New York)

- M782, New Mexico, 1862-1870, 1 roll

- M603, New York, 1862- 1866, rolls 18-218 (with New Jersey

- M784, North Carolina, 1864-1866, 2 rolls

- M787, Pennsylvania, 1864-1866, 107 rolls

- M788, Rhode Island, 1862-1866, 10 rolls

- M789, South Carolina, 1864-1866, 2 rolls

- M791, Texas, 1865- 1866, 2 rolls

- M792, Vermont, 1862-1866, 7 rolls

- M793, Virginia, 1862-1866, 6 rolls

- M795, West Virginia, 1862- 1866, 4 rolls.

Click here for a printer-friendly version of this article.

Juliana Smith has been an editor of Ancestry newsletters for more than nine years and is author of “The Ancestry Family Historian’s Address Book.” She has written for “Ancestry” Magazine and wrote the Computers and Technology chapter in “The Source: A Guidebook to American Genealogy,” rev. 3rd edition. Juliana can be reached by e- mail at [email protected], but she regrets that her schedule does not allow her to assist with personal research.

This is good to know about, but I was disappointed to find that Kentucky is not included in the list of states for which the lists are available at Ancestry. It looked as though the assessments were done for Kentucky (if I interpreted the NARA website correctly) yet it is not included in the Ancestry database. Any particular reason? Any hope of it being included later?

Thanks

I don’t get it. The database says 1862-1918, yet the films generally only cover 1862-1866, with one or two that go to 1870 or 1872. What am I missing?

Thanks Juliana!!

I have now spent more time with this IRS database – looking for an Irish immigrant family member who is not on US census until 1870. Finding his location in the tax records in the 1860s may help us locate his naturalization records. I’m very happy to see your additional information here, especially the helpful listing of each state’s district numbers, and the reminder to use the hovering mouse to see districts without having to click through. Thanks also for explaining how you found the family group – the record of tax on an estate.

I’ve also learned just from spending some time with this database myself, so your readers should probably just expect to have to learn how to use what is here. It’s not as familiar or easy to use as the census but it does include many years in an important time of our country when other immigrants besides my own family were “on the move.” I first printed out the listings for the name/state and then made notes on the printout – which district, occ., address. This makes it easier to work with, to sort and study search results later. I also printed out images of the tax records which I think are g g g uncle.

The first commenter here raises a point I have wondered about – since there are more tax years listed on the database – are there more to come?

I found this database very interesting, and located two ancestors who were taxed for their “manufacturing license” and “physician’s license”. However, I noted that in the “Unknown” database, there are at least 2,000 pages of Kentucky lists that are very legible. I had ancestors in Kentucky during this time, but that is a lot of pages to browse through to find them. Will this section be indexed in the future?

I have to agree with Larry Bidwell. I don’t know that these will be much good for me unless later years are added. Sue

I get the impression that these listings are mainly property owners or company owners. Does anyone know if just plain ‘regular’ people are accounted for as well?

Am I missing Tennessee? I found relatives in both East and West Tennessee, but do not see it listed above.

Thanks

Juliana, Thanks so much, I was just about to do the research and there you were. However, either I am having a senior moment or are just thick, but I got a blank page when trying to access the NARA page and never found a blue microfilm button.

Help someone

I just found another typo people need to be aware of. Ancestry has over 88,000 times where the typo Jospeh appears in the index instead of Joseph. People using the exact search to look for a Joseph also need to try the spelling Jospeh. If they are using a soundex search, this won’t matter.

My family was in Ohio and you do not have Ohio listed. Does that mean that Ohio is not in the records?

Julianna, This articles is very informative, but I did not see OHIO listed in the list of mircofilm numbers. Are these records not available? I know the district number for Hamilton County in Ohio is 31, would this be the number that I use to look up the records I need? Thanks for all your help.

Thank you for this article! I helped me save time by being able to pinpoint the exact district.